|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Should I Refinance FHA Loan for Better Financial Management?Understanding FHA Loan RefinancingRefinancing your FHA loan can be a strategic financial move, but it's essential to weigh the pros and cons. By refinancing, you might secure a lower interest rate, reduce monthly payments, or switch from an adjustable-rate mortgage to a fixed-rate mortgage. But is it the right choice for you? Reasons to Consider Refinancing

Potential DownsidesWhile refinancing can offer benefits, there are also costs and considerations to keep in mind.

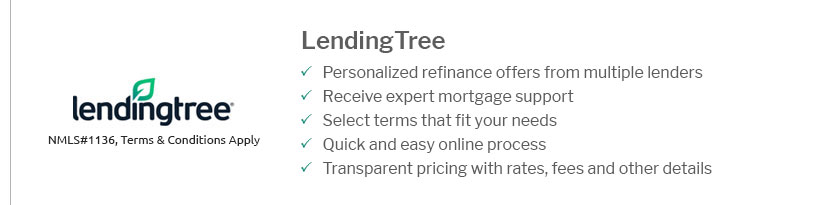

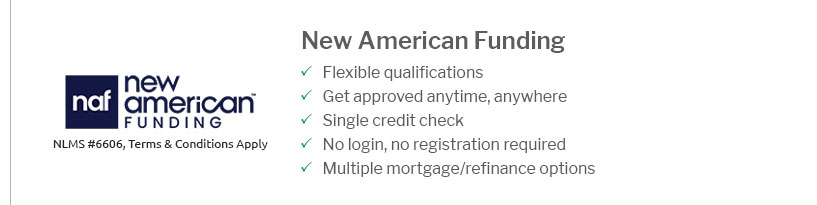

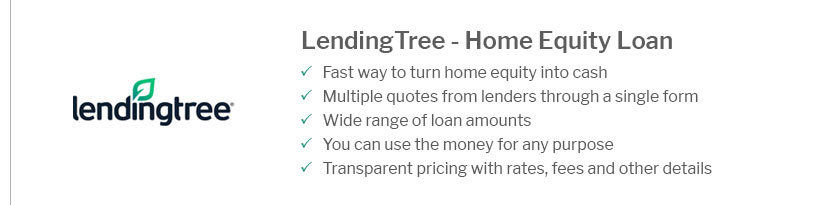

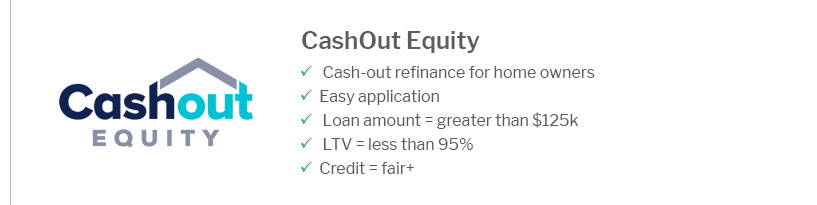

Before deciding, consider getting a free refinance quote to understand your options. Steps to Refinance an FHA LoanEvaluating Your Financial SituationAssess your current financial status, credit score, and long-term goals. Refinancing should align with your financial objectives. Comparing LendersShop around for the best rates and terms. Different lenders may offer varying rates, and it's worth comparing multiple offers. Application ProcessOnce you've selected a lender, the application process is similar to your original mortgage application. Be prepared with financial documents and a property appraisal. For those who previously refinanced through the harp refinance loan program, it's crucial to understand how changes in government programs may impact your options. Frequently Asked Questionshttps://money.usnews.com/loans/mortgages/articles/can-you-refinance-an-fha-loan

Homeowners with FHA loans can refinance to either a new FHA loan or a conventional loan, as long as they meet eligibility requirements. The ... https://www.americanfinancing.net/refinance/fha-home-loan

Any homeowner should look into a refinance FHA loan if they're interested in lowering their rate and payment or taking out cash. A lower rate could mean ... https://www.jvmlending.com/blog/when-and-how-to-refinance-your-fha-loan/

However, as your financial situation improves or market conditions change, refinancing your FHA loan could save you money or provide other ...

|

|---|